We still have incomplete projects awaiting financing…

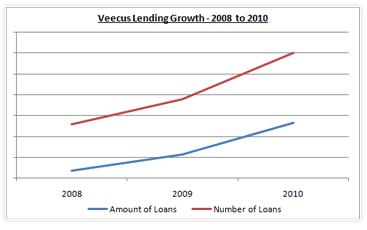

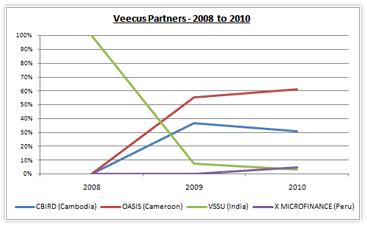

2010 – Veecus continues to grow … Despite the challenges and management changes that interrupted our activities for several months in 2010, last year showed another increase in our portfolio of projects and micro-entrepreneurs financed.

As a Veecus lender, you lend interest-free to the micro-entrepreneurs, however the loans are fully guaranteed by the respective local micro-entrepreneur financial partner. Thanks to this guarantee, we have not had a single default since the launch of Veecus in 2008 and 2009, and this was again the case in 2010. All loans were reimbursed in time by our partners. In order to give you an idea of how valuable this guarantee is, we are going to share with you some field information provided by our local partners.

Below are some of the statistics since the launch of Veecus in 2008:

In 2011, we would like to take these numbers and multiply them by 50! How can we achieve this ambitious target? In 3 different ways:

- We must increase the number of loans available for financing on the website.

- First, with our existing partners placing loan requests more regularly on the Veecus website (OASIS Microfinance has already started to do so).

- Second, we are going to partner with a microfinance association that is already active with a number of NGO’s.

This way we will be able to increase the number of partner Microfinance Institutions (MFIs) and reach new countries and regions.

- We must increase the number of Veecus members, and why not start with Europe. And the best way to do this is if you help us. There are already almost 800 Veecus members, of which almost 500 are active members. Here is how:

- If each one of you forwards the Veecus link to 10 relatives, friends, colleagues, we could very quickly reach 5000 members. And then they would in turn do the same, and so on…

- Veecus is going to hire a dedicated permanent staff member.

News from the micro-entrepreneurs

Andin Mbella

The OASIS impact assessment team noted that due to the loan Andin Mbella received, he had been able to acquire one and a half hectares of additional farmland on which he was able to cultivate more pineapples trees. This definitely has upgraded his financial situation and he says he will now be able to pay for his children school fees, no more tears.

Juliet Lekelefac

Mrs Juliet Lekelefac was able to meet her loan repayment schedule promptly. Thanks to the loan she received, she does not only sell fresh produce as before but she is also now retailing rice and garri.

On a more personal note, we were saddened to find out that her grandchild was bitten by a deadly snake and did not survive. We send our condolences to Mrs. Lekelefac and her family.

Nganda Chenwi

Thanks to the benefits arising from the loan that was extended to her, Mrs Nganda Chenwi has been able bring electricity to her home. She has also opened a savings account. She says the savings will be used for her children’s education next September.

News from the micro finance institutions (MFI)

Many of you asked for this kind of information, so we have been pushing our partners to share with us as much information as possible. In our next newsletter, we will be publishing information such as average loan size, average interest rates charged, average loan duration, default rates, level of indebtedness of micro-entrepreneurs, types of businesses supported, gender/family size etc. Of course, some details may not be available, but the objective is to gradually collect and provide you regular updates from our local partners.

Twitter and Facebook

Are you following us yet? If not, you should be! We are connected to a number of interesting microfinance information providers, and this is the best way to learn or simply stay informed about this topic.

- To follow us on Twitter, click here

- To follow us on Facebook, click here

Did you know?

Your Veecus profile is a good way to promote your motivations, thoughts and ideas to other members. Why not take 5 minutes to update it with a logo, your photo, your passions and ambitions, or anything that best identifies you. And finally, try to be as precise as possible about your location. This will ensure that our Google maps of co-lenders and borrowers is as accurate as possible. We do not share these details, as they are only used for location purposes and when reimbursements are requested.

Additionally, if you are going to create a fundraising campaign, it is another way for people know why you are doing this.

Corporate members

If you would like your employer, or your own company, to join as a Veecus Corporate, wait no longer! Give us their contact details ([email protected]) and we will be in touch with them to explain our Corporate Services offer.

Our local microfinance partners:

The OASIS impact assessment team noted that due to the loan Andin Mbella received, he had been able to acquire one and a half hectares of additional farmland on which he was able to cultivate more pineapples trees. This definitely has upgraded his financial situation and he says he will now be able to pay for his children school fees, no more tears.

The OASIS impact assessment team noted that due to the loan Andin Mbella received, he had been able to acquire one and a half hectares of additional farmland on which he was able to cultivate more pineapples trees. This definitely has upgraded his financial situation and he says he will now be able to pay for his children school fees, no more tears. Mrs Juliet Lekelefac was able to meet her loan repayment schedule promptly. Thanks to the loan she received, she does not only sell fresh produce as before but she is also now retailing rice and garri.

Mrs Juliet Lekelefac was able to meet her loan repayment schedule promptly. Thanks to the loan she received, she does not only sell fresh produce as before but she is also now retailing rice and garri. Thanks to the benefits arising from the loan that was extended to her, Mrs Nganda Chenwi has been able bring electricity to her home. She has also opened a savings account. She says the savings will be used for her children’s education next September.

Thanks to the benefits arising from the loan that was extended to her, Mrs Nganda Chenwi has been able bring electricity to her home. She has also opened a savings account. She says the savings will be used for her children’s education next September.