A guest post in english by Kevin Gentle. By courtesy of the Institut Hayek -

“There are two superpowers in the world,

the USA and Moody’s bond rating division

and it is sometimes unclear which of them is more powerful”

Thomas L. FRIEDMAN

Turning lead into gold... What alchemists sought to do with alembics and test tubes, Credit Rating Agencies (acronym: CRAs) have done with the help of complex algorithms and an exotic approach to risk assessment. These modern time magicians now facing a heavy fire of critics have for years held the key to the magic formula that kept mortgage-based derivatives markets running and money flowing into their coffers. With a stroke of their pen, a combination a 2 or 3 magic letters, these agencies had power of life and death over thousands of financial products. They were the conductor of this great crazy orchestra that suddenly stopped playing one fateful autumn day of 2008.

How did we end there ?

But how did it all come to this? How can thousands of experienced investors and dozens of venerable institutions have all been fooled into blindly trusting the underlying solidity of assets they had little understanding of? How did the mortgage-based derivative disease spread across the financial system like wild fire without anybody ringing the alarm bell before well after it was to late?

As after every major crisis, an army of self proclaimed experts now glorify their egos by subscribing to the easy, populist view: It is all the market’s fault. Liberalism, deregulation and unfettered competition are to blame. Credit Rating Agencies are the ugly child of the free market. Their role should be assumed by the state. They and they only have made possible the crisis we now have to fight with taxpayers’ money.

Unfortunately, these allegations are based on little more than an ideological allergy to free markets that runs deep in the minds of our intellectual elites. The sheer facts and numbers tell a radically different story. This essay will aim at showing how credit rating agencies, despite their flawed methods and incompetence, could only enjoy such importance because of red tape and regulations. It will highlight how banking regulations gave these intrinsically imperfect organizations a completely disproportionate role and how governments are to blame for what many are too happy to attribute to reckless liberal ideology.

Historical look

Before Credit Rating Agencies’ power could rival those of the USA (in the words of Thomas Friedman, quoted above), these actors were somewhat marginal players and enjoyed a reputation of grumpiness, seriousness and honesty. Before regulations came and changed the rules of the game, credit rating agencies got their money from investors who subscribed to their ratings and advices. Their ratings were strictly informational, had no legal force whatsoever and investors were free (and indeed often did) to ignore them. In such a context they only provided markets with what might well be considered their most precious fuel: information. By releasing information about financial products and their issuers, they added transparency and helped investors take informed investment decisions.

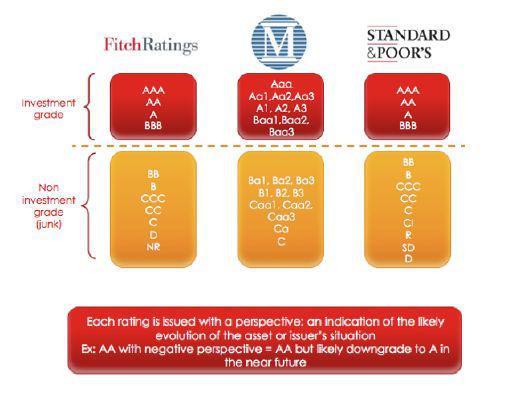

And then came government and its foolish aim to put an official stamp on everything. In 1975, the SEC, wanting to control the risk banks and other investors took sought to establish an official definition of risk. To do so, they recognized three official credit rating agencies: Standard and Poor’s, Moody’s and Fitch ratings whose ratings were now to enjoy legal force. Since the enactment of the law, other agencies have joined the club but the “Big three” retain their pre-eminence and now appear as the most powerful actors in the financial system. The consequences of this legislative move are numerous and far reaching.

These regulations created an oligopoly for the selected agencies and guaranteed them a steady stream of revenues. It also created a de facto obligation for issuers of financial products to have said products rated since capital requirements and the structure of investors’ portfolios depended on these ratings. Indeed, the lower the risk of assets on a bank’s portfolio, the less capital it had to carry and the more money it could invest. Holding high rated assets allowed banks to free up capital, which made them seek actively such assets. What’s more, pension funds were barred from holding anything below AA and similar restrictions were placed on the structure of mutual funds and other such investors’ portfolio.

As a result, a product’s worth depended more than ever on its rating and issuers were forced to submit their products to the all-powerful agencies. The consequence was a radical change in these agencies’ business model. Whereas they previously received their money from investors who trusted their ratings, they were now paid directly by the issuers of financial products. In the word of Johan Norberg, “This amounted to buying a house which value had been assessed by an agent paid by the seller”. I strongly doubt whether any sane home-seeker would ever do that…

Many self called financial experts claim that credit rating agencies enjoyed their power and actively pushed government to expand their influence. In reality, high-ranking executives of these agencies were among the most vocal critics of the above-described regulations. The words of Thomas Mc Guire, Moody’s chief of corporate ratings are eloquent: “ Rating agencies are staffed by ordinary people with families to support and bills to meet and mortgages to pay. Government regulators are inadvertently subjecting those people to improper pressure and share accountability for any scandal which may result ”.

Current role and legal status

Despite the controversy surrounding them, credit rating agencies have an important function: they provide markets with information. They issue ratings of both financial products (assessing the risk associated to them) and issuers of financial products (evaluating their solvency and the likeliness of default).

Their ratings influence the price of financial products. This is especially true for the most complex products for which no liquid market exists (which was the case for many complex derivatives such as CDOs until the creation of the ABX.HE). They also influence investors’ trust in issuers of financial products and thus the cost of borrowing of governments and companies alike. The recent downgrading of Greece and Spain’s ratings, which triggered a sharp rise in both the interest rate of their treasury bonds and corresponding CDS is truth of that.

The ratings issued by CRA also contribute to shaping the structure of investors’ portfolio. As previously showed, many mutual and pension funds are barred from holding anything below AA or in some cases AAA. The European Central Bank itself cannot hold Treasury bonds rated below BB.

According to the Basel II agreements, capital requirements for banks depend on the risk-weighted composition of their portfolio. The complex formulas used to calculate the appropriate amount of capital banks are to hold used ratings from CRA to assess assets’ risk. The amount of capital banks must hold thus depends on the letter apposed on the assets they own, which makes CRA all the more powerful and influential.

Controversy and role in the financial crisis

Much had been said and written lately about CRA’s chronic failure to properly accomplish the mission they were trusted with. A look at their recent history indeed shows a worrying incapacity to foresee major financial earthquakes and a troubling tendency to react a posteriori. For instance, Enron’s notation remained at investment grade until 4 days before what remains one of the greatest bankruptcies in history. CRA’s also failed to foresee the 97 Asian crisis and the 2001 Argentinean debt crisis. Furthermore, it today appears that CRA were out like bandits stamping AAA CDOs that turned out to be worth nothing.

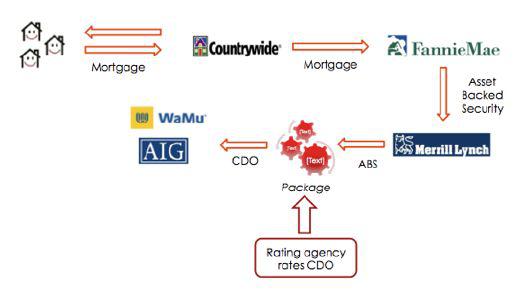

The incompetence was apparent in the way they attributed notations to CDOs. The following graphic shows how this kind complex mortgage based commodity is built and at which stage CRAs come into play.

CDOs are structured financial products based on financial assets. In their most common form, they are made of mortgages packaged and are then divided into tranches according to the level of risk. It should be noted that no mortgage is actually owned by one investor. Holding the safest tranches does not mean owning the soundest mortgages, it simply means that you will be the last one to be hit if things go awry.

Government's interventions hiding actual risks

The solidity of a CDO thus logically depends on the solidity of the mortgages it is built with. But in reality, things are much more complicated since CDOs are believed to be removed from the actual housing market. Indeed, the mortgages after being granted by companies such as Countrywide were bought by the two government sponsored enterprises Fannie Mae and Freddie Mac (as part of government’s scheme to increase home ownership) who guaranteed to buy virtually any mortgage however bad it was.

The intervention of these two government sponsored enterprises made investors treat anything they touched like treasury bonds (the safest investment in the world) and blinded them to the risk associated to the products they created. Fanne and Freddie then proceeded to create an Asset Backed Security (which they guaranteed) composed of mortgages from all over the country (to diversify risk exposure). This ABS was then divided into tranches much like a CDO and these tranches were bought by investors (mainly banks) who in turn packaged them into a CDO.

Getting rid of the original mortgages allowed mortgage lenders such as countrywide not to have to wait for 10 or 20 years to get their money back. Reselling mortgages allowed them to free up money to grant more loans and thus generate more revenues. The downside was that since Fannie and Freddie guaranteed to buy the loans, lenders paid little attention to the solvability of borrowers and granted loans on incredibly favourable terms to households who didn’t deserve even a credit card. When times were good, households could in many cases take out a loan without even having to provide the lender with such basic information as credit history, detailed household income etc… Lenders often had little clear idea of whom they were lending money to and little did they care. Nor did investors seek to know more about the solidity of the mortgages since the intervention of government sponsored enterprises and the guarantee on the ABS they created made everybody blind to risk.

Mortgage securitization: a cash cow

All this brings us back to our CRAs. When a bank wants to create a CDO, it needs to have it rated by an agency and had better get a good grade if it wants anybody to buy it. Originally, CRAs estimated that no CDO consisting solely of mortgages could be given an investment grade notation because the degree of risk diversification was way too low and the product was too exposed to the fluctuations of a single market. But as CDOs became more and more popular and the government inflated the housing market with its three giant pumps that were the FED, Fannie and Freddie; CRAs came to realize how much money they could make by re defining their grade attribution criteria. The aim was to make customers come to them rather than their competitors and for that, bringing out the AAA stamp was necessary.

Mortgage securitization was a cash cow, and CRAs were milking it as if there were no tomorrow. Even Moody’s, the most conservative of them, abandoned its diversification requirement in 2004. As its CEO explained “it was a slippery slope. What happened in 2004 and 2005 with respect to subordinated tranches (the riskiest tranches of CDOs) is that our competition, Fitch and S&P, went nuts. Everything was investment grade”. The strategy could not be any more profitable, a single rating could generate over $200 000 of revenues and took little more than a day (in some cases a few hours were enough). In 2005, securitization accounted for over 40% of Moody’s sales.

At a hearing at the House of Representative, one document (an internet chat between two S&P analysts) was produced that shows the extent of the CRAs’ foolishness.

1- By the way, that deal is ridiculous

2- I know, right, model definitely does not capture half the risk

3- We should not be rating it

4- We rate every deal. It could be structured by cows and we would still rate it

Financial journalist Roger Lowestein investigated how Moody’s rated CDOs. To preserve confidentiality, the CDO was given the name “Subprime XYZ”. It was a package of 2939 mortgage loans made in the spring of 2006 at a total value of over $400 million. The bank that engineered the package provided Moody’s with general information about the borrowers but Moody’s did not seek to consult individual files or confirm the data. “We are not loan officers, our expertise is as statistician on an aggregate basis” explained Claire Robinson from Moody’s.

Indeed, Moody’s Modus Operanti is simply to assess the likeliness of default based on average historical data and information about similar products. The structure would be inspected but the underlying assets (the real mortgage loans that made up the package) would never be looked at. Nobody was in charge of assessing the underlying risk, except the loan officers who has little incentive to do so since they knew that the mortgage would be sold and that they wouldn’t have to support the risk.

Bad behaviour supported by bad statistics

In the end, CRAs were just statisticians, and bad ones with that. Their data was outdated at best and misleading at worst. They based their models on the way house prices reacted to the 2002 downturn. But this downturn was unique in that the Fed had pushed interest rates as far as they would go and house prices kept rising.

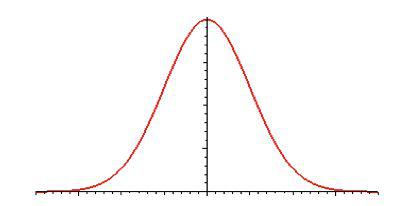

Furthermore, they were over reliant on opaque statistical models and algorithms derived from the Gauss law. The Gauss law when applied produces the well-known bell curve whereby the number of individuals decreases as we move away from the average. But the Gauss Law (which is the foundation of many of the algorithms and formulas used in the financial world) is flawed in that it over-emphasizes the average and underestimates the probability of extreme events. As we can see on the bell curve, the number of subjects associated to extreme (meaning very far from the average figure) figures is fairly low.

All in all, CRAs underestimated the likelihood how extreme events such as a sharp decline in home prices. They assumed that times would always be good and that home prices could only rise in the foreseeable future.

What now?

The CRAs question raises a number of issues that are as much philosophical as they are economic and financial. The regulations surrounding them and the power governments gave to them stem from an insane desire to regulate the behaviour of thousands of investors and to define the indefinable.

Defining risk is impossible. Risk is multiform and in constant evolution. Giving a fixed, official definition of risk will just make investors focus on a certain kind of risk and blind them to new forms that are beyond the scope of the official definition. By forcing investors to refer to notations given by inherently imperfect organizations staffed with normal human being, regulators have highly increased the probability of the current financial disaster.

In the end, it is all about the kind of capitalism we want. Do we want a system in which free and responsible investors do their own research and take a careful look at the solidity of the assets they buy or do we want a system that sees investors stripped of their responsibility by the nanny state being pushed to blindly trust the findings or a handful of government mandated agencies? Had regulators not tried to rigidly define risk in the first place, investors would have had to do their own math, check for themselves the risk associated to certain assets and decide of the appropriate level of capital they had to carry.

CRA were governments’ way of crating a fictitious impression of security and stability. Liberalism is about separating government from business and making it as small as possible. What regulators have done is old fashion dirigism with the connivance of private actors. Strict regulations laying out what you may or may not do, which assets you may or may not hold only exacerbate economic cycles and make investors behave like sheep and follow the herd. While having all investors act the same way because regulators mandates them to (be it via direct intervention or by forcing them to act according to CRAs ratings) might be comforting for politicians and the general public whose understanding of financial market is imperfect at best, it makes crisis all the more serious.

When times are good and the AAA stamp is hot, investors all run after the same assets and trip over each other to get into the same markets. But when things go wrong and the train goes off the tracks, everybody in the market gets clobbered. These repeated attempts to use government intervention to make the system risk proof do nothing but make us more vulnerable to small changes in the market that would otherwise have been quickly absorbed. In the words of John Norberg, “Every attempt at diversification or adaptation has been wiped out by precautionary principles” and investors have come to resemble a sad herd of sheep because of government regulations. Investors should not act the same; this is not what the free market is about, this is not how we will build a stable and efficient financial system.

Government is the problem, not the solution

So what now? Many call for governments to take over the job of CRA and would like to see the creation of an official state run rating agency. But the underlying problem would remain. Companies (especially state owned ones) are prone to mistakes and nothing guarantees that a state run agency would do any better a job than private ones, especially if governments’ interests (for example not having their own grade lowered) come into play. State run companies do not have a good track record of honesty and reliability. The issue is not that agencies have done a bad job. If regulators had not forced investors to subscribe to their ratings the problem would have been much less acute. They would just have lost their credibility, some people would have lost money and life would have gone on. The problem is that giving legal force to CRAs (be them public or private) has simply made investors stupid.

The real solution is to strip CRAs of their legal status and come back to a freer model of capitalism. CRA have a future, just not as government-mandated structures. Their ratings should again become informational and investors should be free to ignore them. Then we will have a capitalism of smart human investors instead of a capitalism of sheep. As Hayek said, “Economics is about showing people how little they know about what they imagine they can control”. Governments and regulators should remember that.

----------