Debts do not have to continue to impede your financial growth. Consolidating your debt is now possible thanks to Dedebt because they have the debt consolidation strategy that will help you reduce your multiple payments to one. Learn the steps to consolidate your debt now.

Stay up to date with your payments

So that you can access the " debt purchase loan " of any bank it is important that you are up to date on your payments. Banks will evaluate that you have a green classification (100% normal) in the risk centers such as Infocorp.

Have verifiable income

As part of the requirements to access this type of loan, banks will ask you to have verifiable income. Usually they must be greater than or equal to the minimum amount that each entity sets. For example, in the Bank it is requested as a requirement to have a net income from 1,000 USD, in addition to work continuity of 6 months minimum.

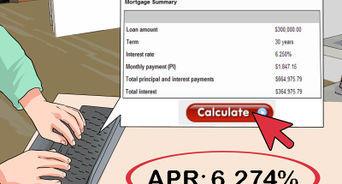

Calculate your finances

This is important before you approach any bank to request this type of service. Calculating your finances will let you know how much money you need per month for your essential expenses. This way you will be able to subtract this amount from your net income, from the rest, allocate a percentage to your emergency savings fund. And so identify how much money you can pay each month to the bank that agrees to consolidate your debt.

If you don't know how much money you have each month to pay the debt and the bank charges you more than you really have, you will end up more indebted with this service than reducing your expenses.

Compare what banks offer you

Banks compete to attract new customers. It is important then that you compare their offers, so it is convenient for the bank that charges you less interest to buy your debt. It is also important that you know in detail the conditions of the service offered.

By knowing the conditions, you can know whether or not you can advance your debt, if you can access benefits such as the wild card fee or the rescheduling of your payments, etc.

Extra tips to succeed in consolidating

If you opt for debt consolidation it is because you want to become free of them soon. To achieve this goal, we recommend you get rid of your credit cards to avoid the temptation to use them and increase your debt. Also design a monthly spending plan that helps you avoid having money you don't have.